U.S. health systems have long struggled with the painstaking process of analyzing and modeling payer reimbursements, leading to a lack of negotiating power when it comes time for contracts between hospitals and insurers. This has left many struggling in their quest for fair increases that reflect the true costs associated with medical care.

Payers have an advantage when it comes to crunching the numbers, and hospitals are not always prepared with detailed data or negotiation plans. All too often this leads them to succumb to contract conditions without a thorough understanding of their actual costs – giving payers leverage over providers in negotiations. Those who come equipped with pertinent facts on service level and cost will be better able to challenge unfavorable terms for mutual benefit.

As reimbursement contracts grow in complexity, hospitals must be mindful of how they handle these negotiations. Without proper systems for managing and understanding all the terms involved—not just spreadsheets — organizations are often at a disadvantage during talks with payors. This could lead to financial losses that healthcare providers can’t afford given their current struggles in patient care management. To ensure success through negotiating reimbursements, efficient tools, and workflows should be employed so facilities understand what each service costs them as much as it earns them!

Different data points for payer-provider contract negotiation

When it comes to negotiating a payer-provider contract, there are a few key data points that you’ll want to keep in mind. By understanding what these data points are and how they can impact your negotiation, you’ll be in a much better position to get the most favorable terms for your contract. Below are a few examples

- Financial data: This includes claims data, cost of care data, and other financial metrics. For example, providers may need to provide claims data to the payer to demonstrate the actual cost of providing services. This data can be used to negotiate reimbursement rates, determine the impact of utilization management programs, and ensure that the contract is financially feasible for the provider.

- Quality data: This includes data on patient satisfaction, readmission rates, and other quality measures. For example, providers may need to provide data on patient satisfaction scores to the payer to demonstrate their commitment to quality care. This data can be used to negotiate quality metrics and ensure that the contract promotes high-quality care.

- Utilization data: This includes data on the utilization of services, such as the number of visits, tests, and procedures. For example, providers may need to provide utilization data to the payer to demonstrate the effect of utilization management programs. This data can be used to negotiate utilization management programs and ensure that access to necessary care is not unduly restricted.

- Contract compliance data: This includes data on compliance with the terms of the contract, such as claims submission timeliness and claims accuracy. For example, providers may need to provide contract compliance data to the payer to demonstrate that they are meeting the administrative requirements of the contract. This data can be used to ensure that the contract is being executed as intended.

These are just a few examples of the types of data that may be needed for payer-provider contract negotiations. The specific data that is needed will depend on the unique needs and circumstances of each party. It’s important for providers to have accurate and up-to-date data to negotiate fair and equitable contracts with payers.

Finding common ground – how can data be used to find areas of agreement between payers and providers, and what concessions may need to be made in order to reach a final contract agreement?

To find common ground between payers and providers, data can be utilized to give both sides an accurate view of their negotiations. This data includes information such as the price of services, procedures, and treatments, the number of providers in a certain area, what types of coverage can be offered, and more. To reach a final agreement, both payers and providers will need to make concessions. Some examples include compromising on price points, selecting favorable coverage options for policyholders or changing operational policies or agreement lengths. Finding common ground is not always easy between these two groups but understanding each side’s priorities and using data to guide discussions can help parties understand their respective positions and create an equitable outcome that all can agree on.

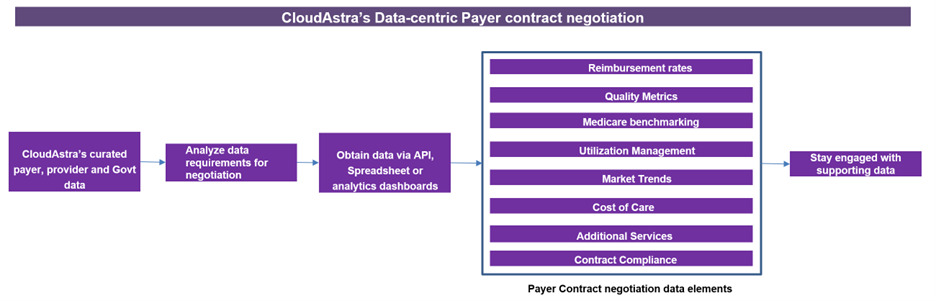

How CloudAstra can help with contract negotiation data?